Support volunteer drivers

The Volunteer Driver Coalition is working to protect the viability of volunteer driver programs to help people thrive in their communities.

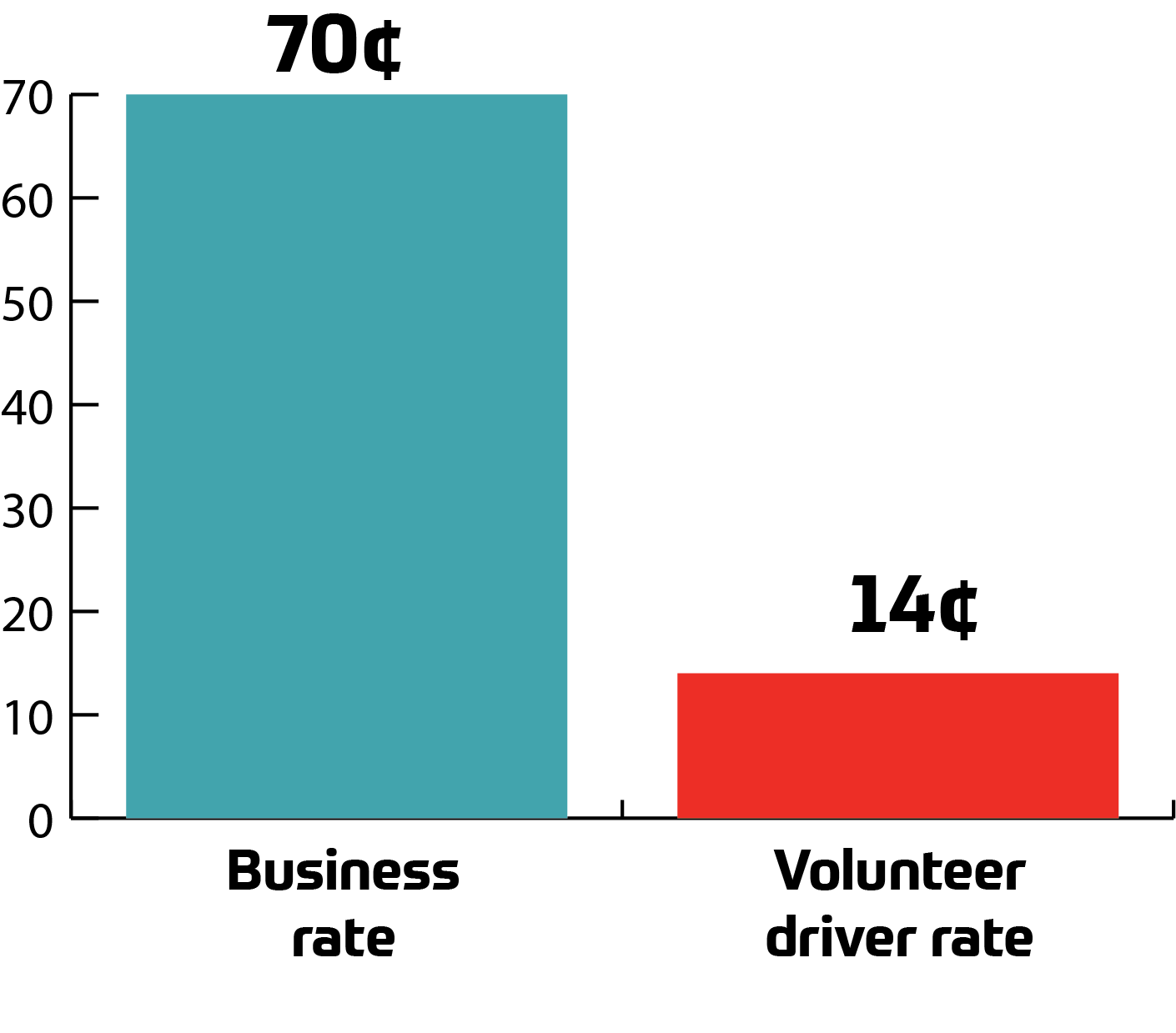

Our goal: Pass federal legislation that will raise the amount of mileage reimbursement that volunteers can claim as exempt from federal taxes from 14 cents per mile to 70 cents per mile (equal to the current business rate).

Volunteers provide a valuable service, contributing their time and knowledge. They should receive the same financial benefit for mileage costs as business drivers.

This important volunteer

service is at risk

168,000+

rides

77,000+

people

9.5 million+

miles

Minnesota volunteer drivers give older adults, people with disabilities, and others access to healthcare, delivered meals, and other key services.

Organizations are facing increasing barriers to recruiting and retaining volunteers. Learn more.

Next steps

We have made progress since 2021 but there is more to do. The Coalition is turning its attention to ensuring that the charitable mileage reimbursement rate paid to volunteer drivers matches the business rate.

Knowing the essential role that volunteer drivers play as part of the transportation system, the Coalition believes that volunteer mileage should be reimbursed at a rate that reflects the actual costs of owning and driving a personal vehicle for charitable purposes. Volunteer drivers donate their time, reduce isolation for riders and provide millions of rides each year for older people and those who do not drive.

We need your help

Join the Volunteer Driver Coalition to protect this valuable resource.

COALITION MEMBERS

Members include nonprofit organizations, cities, counties, Regional Transportation Coordinating Councils, and others.

ADD YOUR VOICE

We need your help to pass legislation that supports volunteer drivers. Ask your congressional members to take action.

CONTACT US

Coalition members are happy to provide information about the need for this legislation and how you can help.